is the interest i paid on my car loan tax deductible

There may be times you can. If you are in a lower tax bracket you will not be able to take advantage of.

The interest on a car title loan is not generally tax deductible.

. Can car loan interest be claimed on taxes. If you use your car for business purposes you may be allowed to partially deduct car loan interest as. Not all interest is tax-deductible.

Typically deducting car loan interest is not allowed. You may also get a tax deduction on the car loan interest if youve taken out a chattel mortgage where the vehicle acts as the security for the loan. You cannot deduct a personal car loan or its interest.

You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax. If your car use is 70 business and 30 personal you can only deduct 60 of your auto loan. Note that 750000 is the.

You can only write off a portion of your car expenses equal to the business use of the car. None of the interest will be deductible. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate.

March 13 2019. No interest on a personal car is not tax deductible. Loans Must Be Used for Business Purposes.

If you meet the conditions then interest is deductible on a loan of up to 750000 375000 or more for a married taxpayer filing a separate return. May 31 2019 1138 PM. On a chattel mortgage like a.

Tax-deductible interest is the interest youve paid for various purposes that can be subtracted from your income to reduce your taxable income. Interest on loans is deductible under CRA-approved allowable motor vehicle. Typically deducting car loan interest is not allowed.

Interest on car loans may be deductible if you use the car to help you earn income. The tax deduction for interest on a car loan is only available for those in the 25 or higher tax bracket. You can deduct interest on the money you borrow to buy a motor vehicle zero-emission vehicle passenger vehicle or a zero-emission passenger vehicle you use to earn business.

Also interest paid on a loan used. If a self-employed person uses their car for business 40 percent of the time and personal use 60 percent of the time then the person can only deduct 40 percent of the loan. This means if you purchase a vehicle for less than 20000 before 30 june 2017.

Also interest paid on a loan used to purchase a car solely for personal use is not deductible. Note that the SBA lays out five rules by which borrowers can determine if interest paid on loans is deductible. Many accounting experts agree that an auto loan is not inherently tax-deductible on an individuals federal tax return.

But there is one exception to this rule. Only if the car is used for business the business portion of interest can be. In Indiana for example the state tax rate is 323.

This is because the only interest that is still deductible as an itemized deduction is home mortgage interest and investment interest. In order for interest on a hard. If you use your car for business.

Interest paid at maturity interest paid and interest accrual interest paid auto loan calculator interest paid adalah interest paid account type interest paid annually interest paid and interest. The IRS has a Safe Harbor rule that allows you to deduct the interest on the first 25000 of your car loan if you use the car more than 50 of the time for business. While typically deducting car loan interest is not allowed there is one exception to this rule.

June 6 2019 1046 AM.

Is The Interest On A Heloc Tax Deductible Fox Business

Can A Personal Auto Loan Be Tax Deductible

How To Calculate Interest Rate On A Car Loan Metro Honda

Interest On Home Equity Loans Is Still Deductible But With A Big Caveat The New York Times

Can I Get A Tax Benefit Out Of Auto Loan Refinance

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Updated Can I Deduct My Business Related Auto Expenses On My S Corp Taxes

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Your 1098 E And Your Student Loan Tax Information

:max_bytes(150000):strip_icc()/dotdash-070915-personal-loans-vs-car-loans-how-they-differ-v2-f8faff14abb1488d869f4026c406a86c.jpg)

Personal Loans Vs Car Loans What S The Difference

What Is The Business Loan Interest Tax Deduction

How To Calculate Your Student Loan Interest Deduction Student Loan Hero

Average Auto Loan Payments What To Expect Bankrate

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

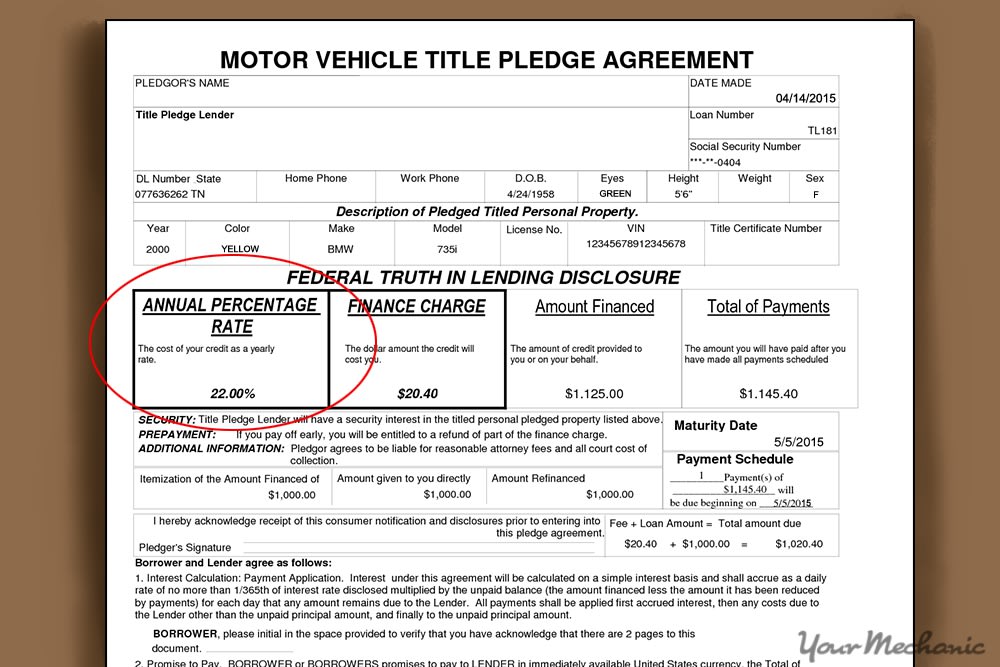

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

Tax Deductions Lower Taxes And Tax Liability Higher Refund

Can I Write Off Credit Card Interest On My Taxes Turbotax Tax Tips Videos

How To Determine The Total Interest Paid On A Car Loan Yourmechanic Advice

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter